Managing your money shouldn’t mean juggling spreadsheets, banking apps, and sticky notes.

With the right Notion template for finance, you can track income, expenses, budgets, and goals in one organized dashboard — and actually enjoy doing it.

In this guide, I’ll show you how to track personal finances in Notion step-by-step, using pro-level features like linked databases, roll-ups, and category filters.

Whether you’re budgeting for the month, planning debt payoff, or growing your savings, this workflow will help you stay on top of it all.

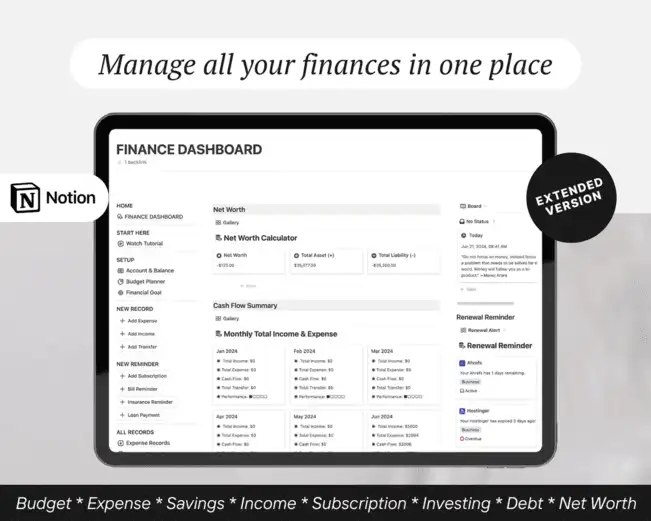

Featured: Notion Template for Finances

P/s: Creating multiple automated formulas in Notion can be time-consuming. If you’d rather skip the manual setup and jump straight into tracking your finances with a ready-to-use system, grab our Notion Finance Template

Core Elements of a Notion Finance Tracker

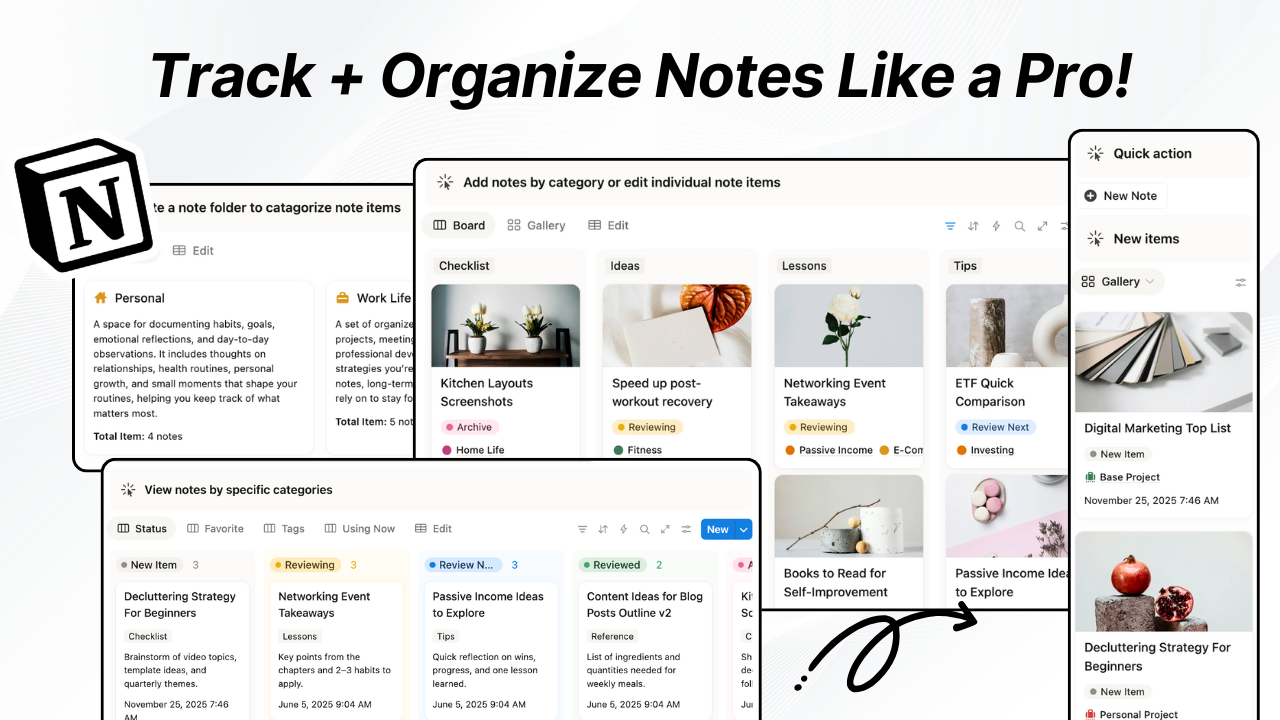

A truly effective Notion finance tracker goes beyond logging numbers — it gives you instant clarity on where your money is going and how close you are to your goals. Here are the key components every pro-level setup should have:

1. Income Tracking

Set up a database to record every source of income — salary, freelance work, side hustles; perfect for tracking multiple income sources. Use date, category, and amount properties so you can filter and analyze trends. With roll-ups, you’ll see monthly or yearly totals instantly.

2. Expense Tracking

An organized Notion expense tracker template helps you group spending into categories (housing, food, subscriptions) and spot problem areas quickly. You can also break it down by going through the expenses spent using each credit card respectively.

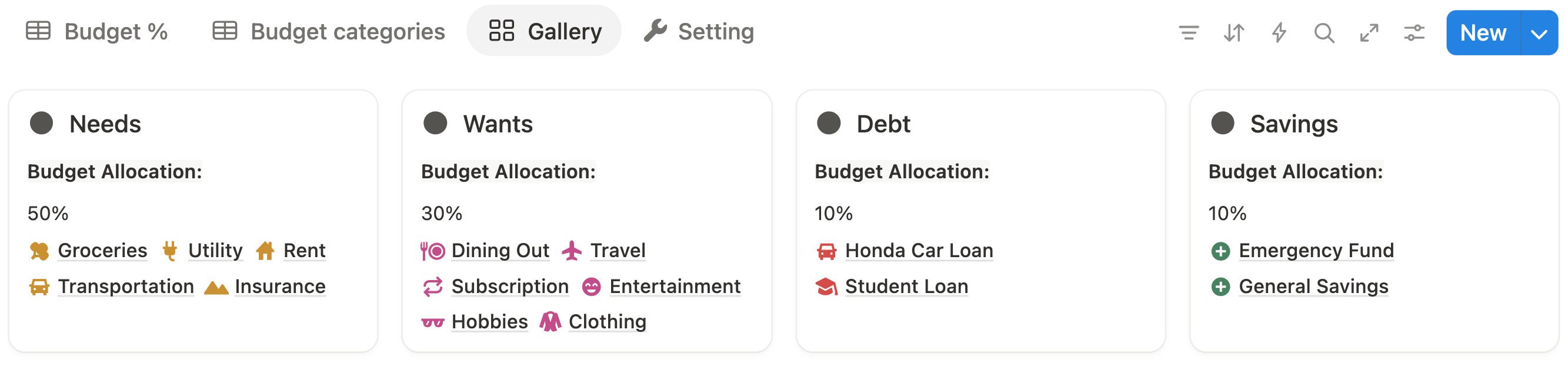

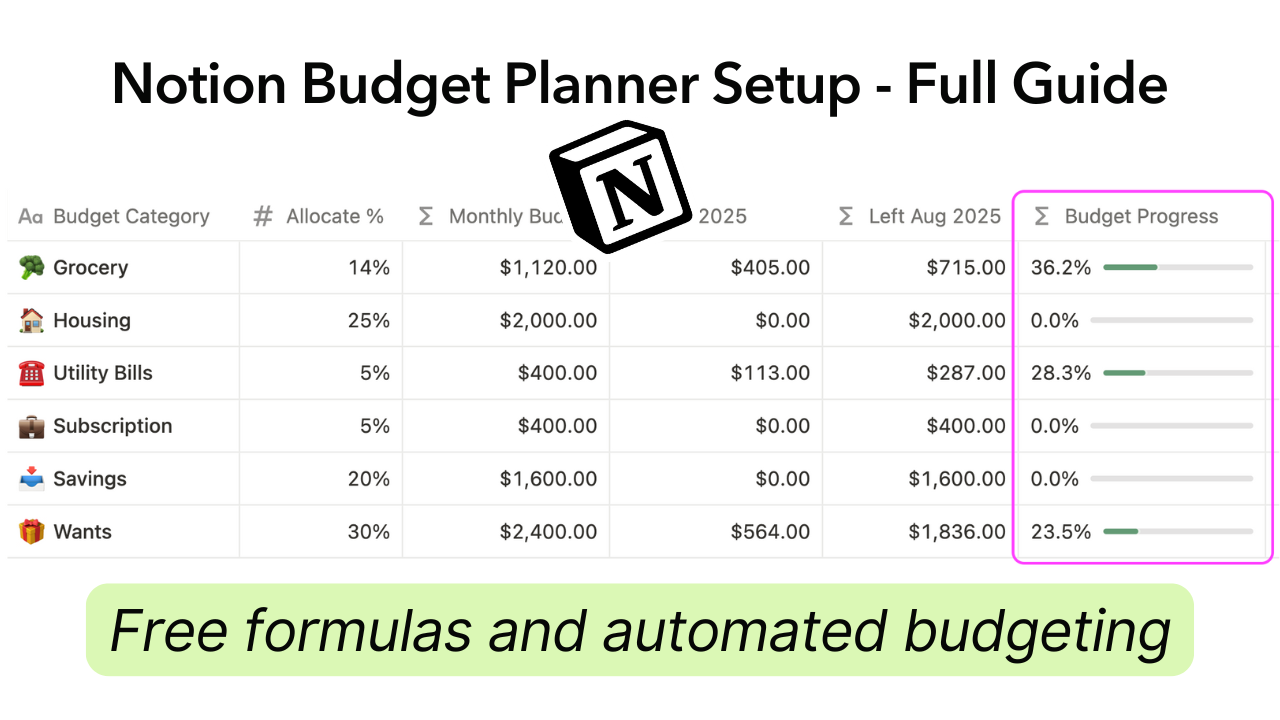

3. Budgeting Planner

Your budget isn’t just a spreadsheet — it’s a plan. Link your expense and income databases to a budgeting dashboard so you can compare actual vs. planned spending in real time.

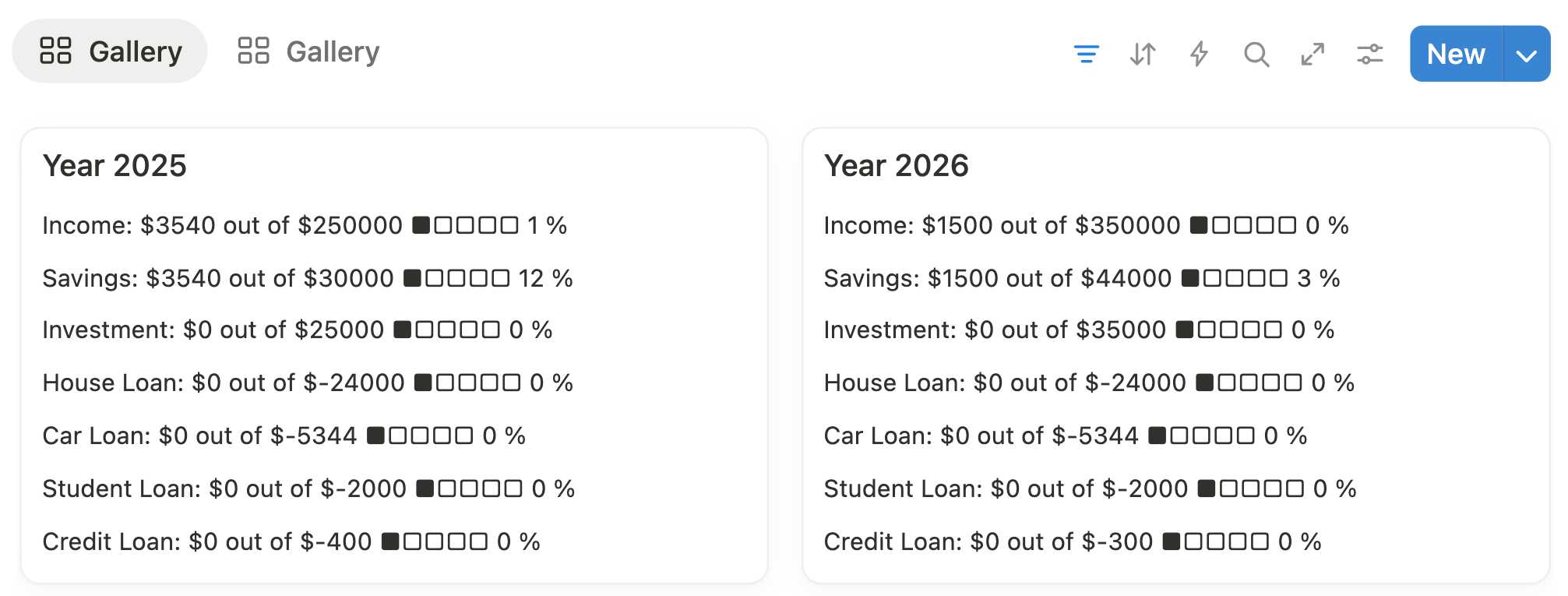

4. Finance Goal Tracker

Map out your big-picture goals — such as saving $10,000, paying off a loan, or reaching a target net worth. A yearly finance goal tracker keeps these ambitions front and center so you’re making consistent progress month by month.

5. Savings Tracker

Track multiple savings accounts or categories (emergency fund, travel, home down payment) in one view. Connect each goal to progress bars or percentage roll-ups so you can visualize growth.

6. Credit Card Tracker

Simplify how you manage credit card debt and track payoff progress—all in Notion.

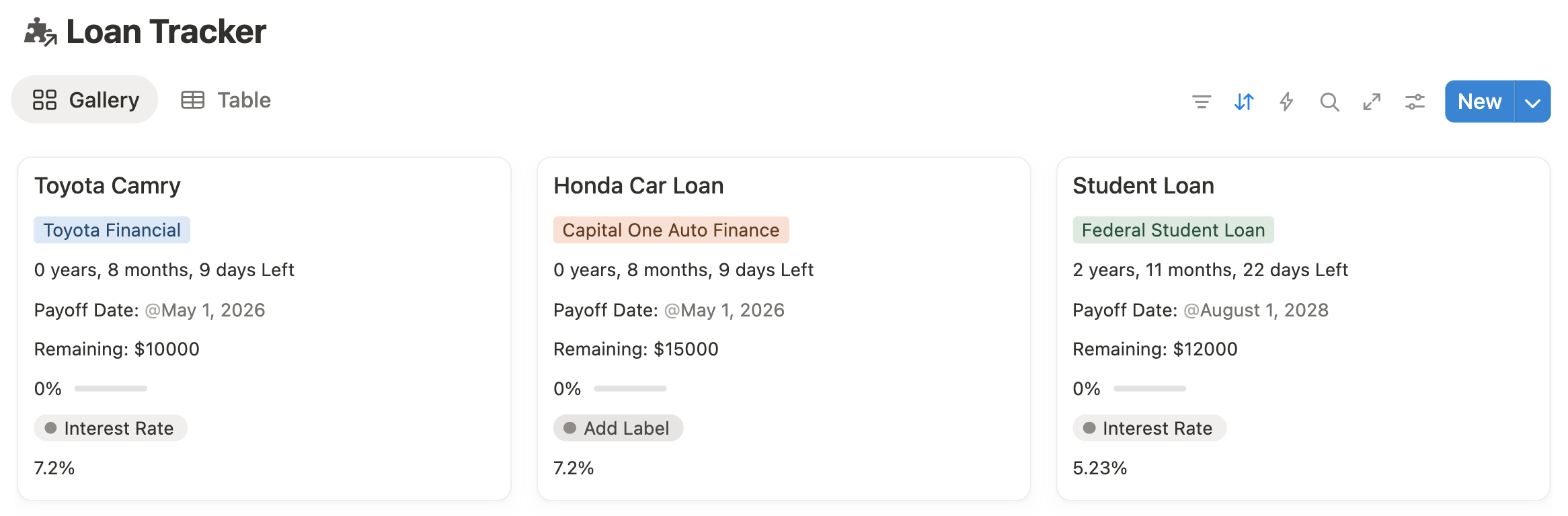

7. Loan & Debt Payoff Tracker

Keep a detailed log of loans, interest rates, and remaining balances. Whether it’s student loans, credit cards, or a mortgage, seeing all debts in one dashboard helps you plan payoff strategies.

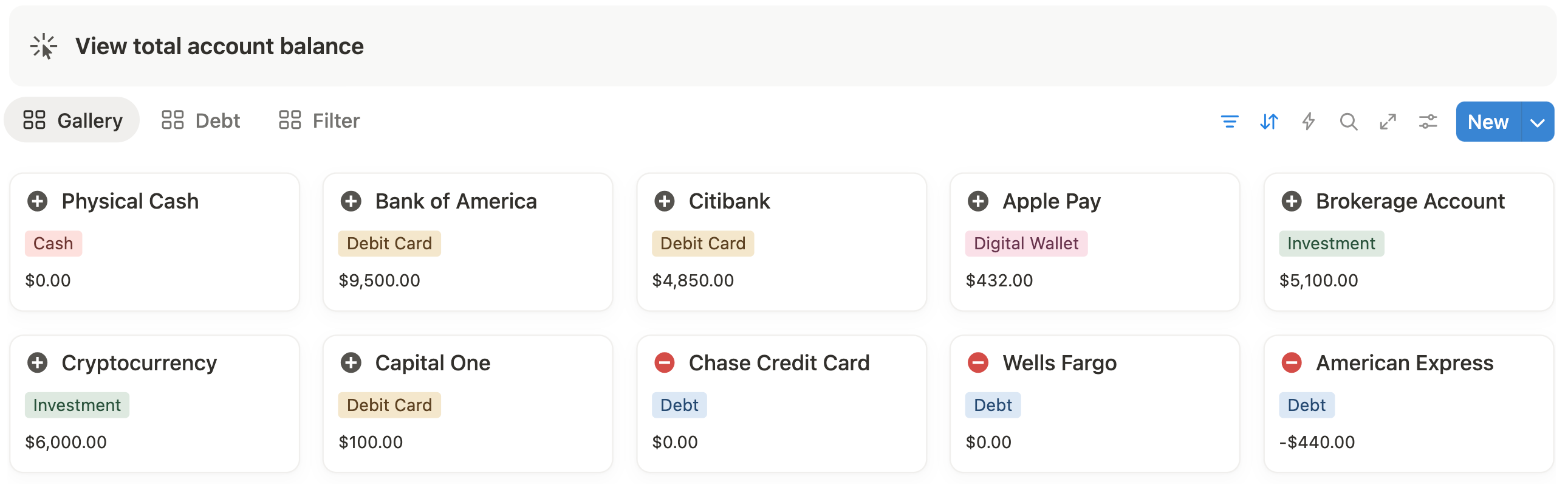

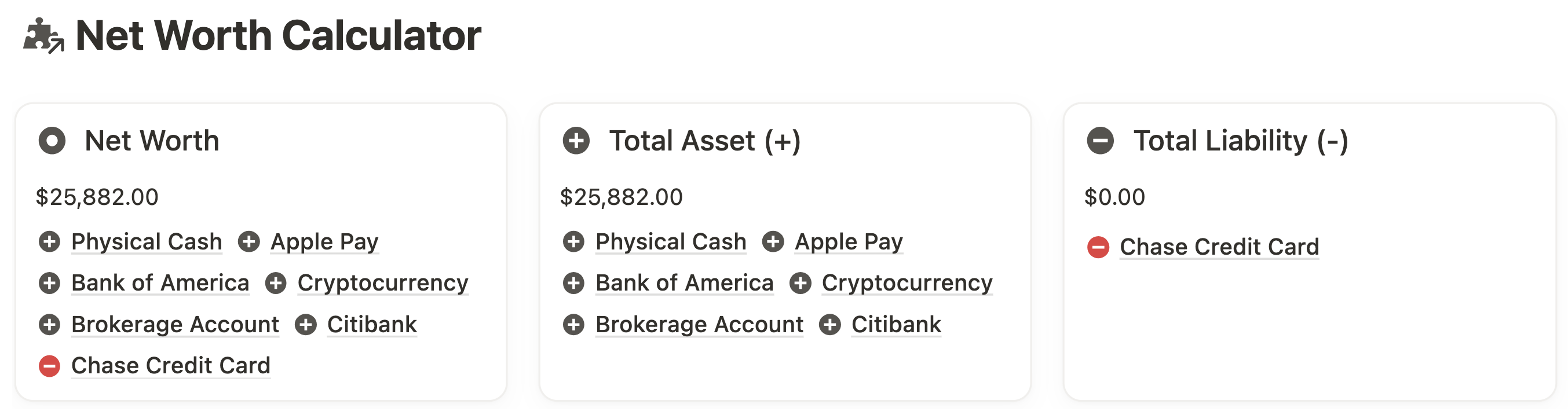

8 Account Balance Tracker

Link your bank accounts, debt accounts, e-wallets, and investment accounts into a single table so you can see your total liquid assets at a glance. This is essential for accurate net worth tracking.

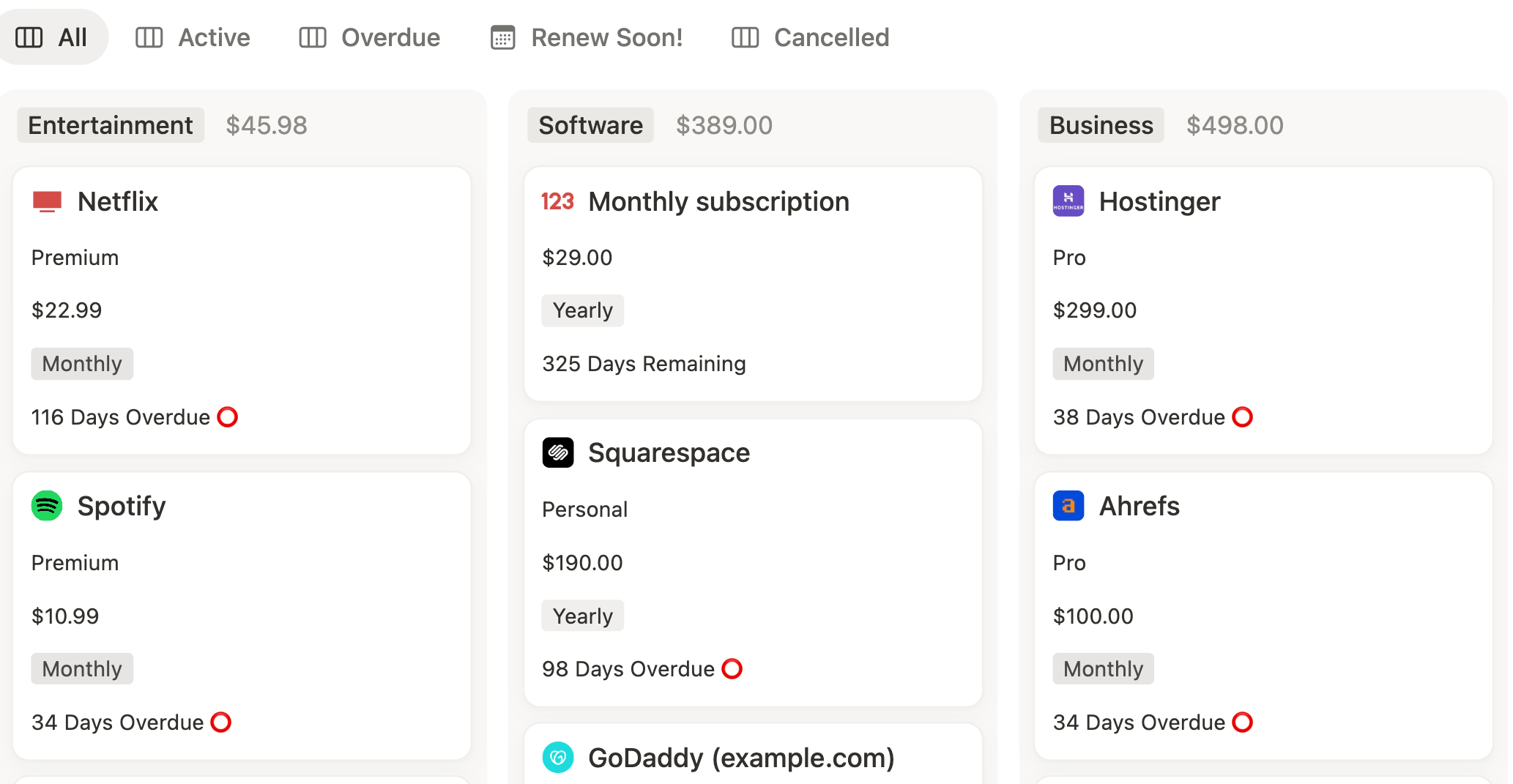

9. Subscription Tracker

Stop money leaks by listing every subscription you have, including renewal dates and monthly costs. Sort by renewal date to decide which ones to cancel before they auto-charge.

10. Investment Tracker

Monitor your portfolio — stocks, ETFs, crypto, or other assets — in a dedicated database. Include columns for purchase date, amount invested, current value, and ROI.

11. Net Worth Tracker

Pull data from your account balances, savings, investments, and loans to calculate your total net worth. Tracking this regularly gives you a true measure of financial health, beyond income and expenses.

Video Walkthrough: Notion Finance Template

In this video, I walk you through the Ultimate Finance Template. If you’re curious about how your finances could look when organized in Notion, this is the perfect sneak peek.

Step-by-Step: Personal Finance Tracking in Notion

A pro-level Notion finance tracker works best when you follow a logical workflow — starting with your accounts, then planning your budget, tracking spending, and reviewing your progress.

Here’s how to set it up:

Step 1: Set Up Your Account Balances

Start by creating a table for all your financial accounts — bank accounts, credit cards, e-wallets, and cash on hand.

- Add columns for Account Name, Type, Starting Balance, and Current Balance.

- You’re not linking your banks directly to Notion (for security reasons) — instead, you’ll manually enter balances.

- When you log an expense or an income transaction, you can tag which account it came from, and the end balance will auto-update via a formula.

Step 2: Plan Your Monthly Budget

Once your accounts are set up, decide on your monthly income and allocate it across categories — housing, food, transportation, savings, etc.

- Assign a percentage or fixed amount for each category.

- Link your budget database to your expense tracker so you can see Budgeted vs. Actual Spending.

- Add a conditional color code or progress bar to warn you when you’re close to hitting your limit in any category.

Step 3: Set Up Your Spending Tracker (Transaction Log)

This is where every dollar gets recorded.

- Create a database with Date, Description, Category, Amount, and Account.

- For income, log it here too — tagging it as “Income” instead of “Expense” — so your cash flow stays in one place.

- For transfer between bank accounts, tag it as “Transfer” and select which account you’re transferring from or to. This will affect the current balance automatically in the Account Balance tracker.

Step 4: Manage Your Loans and Debt Payoff

If you have a car loan, mortgage, student loans, or credit card debt, create a Loan Tracker.

- Add Loan Name, Total Balance, Interest Rate, Monthly Payment, and Payoff Target Date.

- Use formulas to track Remaining Balance and total interest paid over time.

- Linking this to your account tracker ensures payments reflect in your balances automatically.

Step 5: Review Your Progress in the Report Section

Create a weekly or monthly personal finance review routine. Here’s where you go from “tracking” to analyzing trends.

- Budget Progress View – See how much of your budget is spent in each category.

- Spending by Category – Identify overspending trends.

- Finance Goal Tracker – Check progress toward yearly savings goals, debt payoff, or net worth targets.

💡 Pro Shortcut: This workflow is already baked into my Ultimate Finance Template — complete with linked databases, automated balances, budget vs. actual tracking, and visual reports. That means you can skip the manual setup and start tracking your money like a pro in minutes.

Automating Your Notion Finance Templates

Once you’ve set up your finance tracker, the next step is making it work for you — with automation. This is where a well-built Notion personal finance template saves hours every month and keeps your data consistent without constant manual entry.

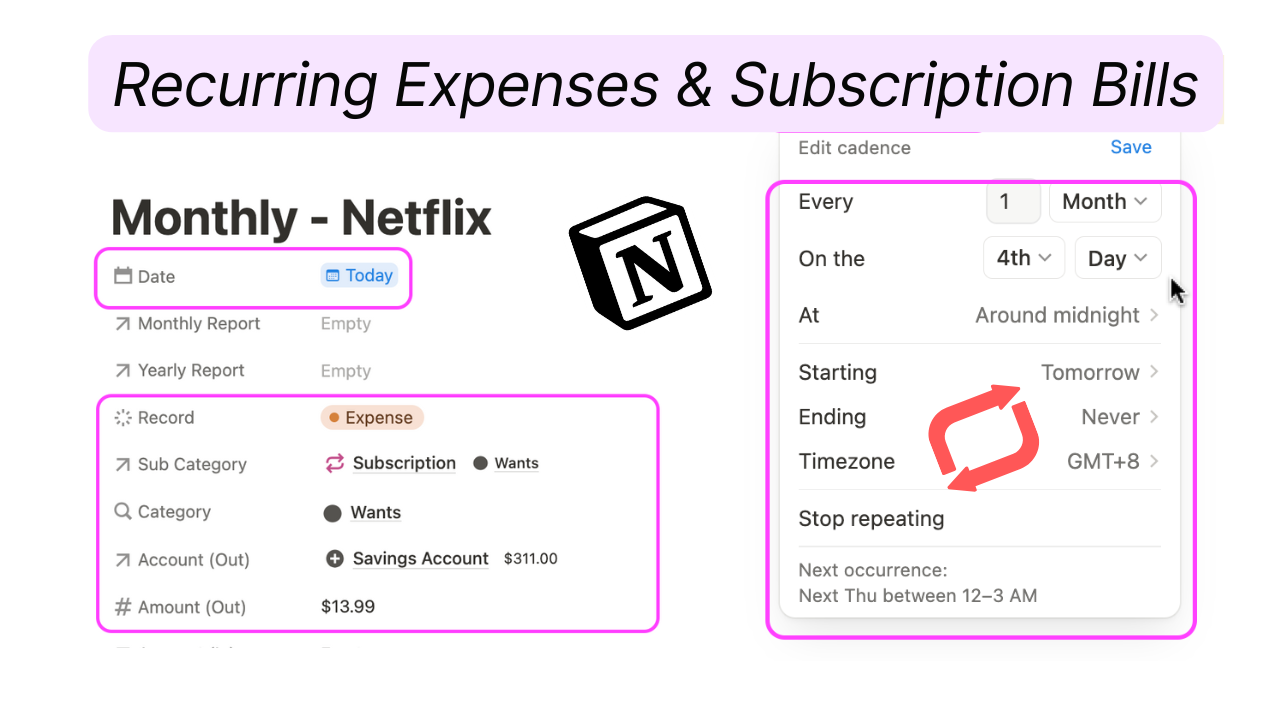

1. Recurring Expenses Tracking

Think about monthly rent, utilities, or subscription services. Instead of entering the same transaction over and over, set them up once so your Netflix bill, gym membership, and rent appear on time every month — without retyping a single detail.

- In your Income & Expense Log, click the template button near “+New” on the top right corner of the database

- Pre-fill properties like Category, Amount, and Payment Method.

- Tag it with a frequency (monthly, quarterly, yearly).

- Duplicate it each month or automate the date shift using Notion formulas so your next due date is always accurate.

2. Automated Subscription Countdown

Never get surprised by an auto-renewal again.

- Create a Next Billing Date property.

- Add a Formula that calculates the number of days until the next charge.

- If you pay on the 14th each month, the countdown automatically resets for the next cycle.

💡 This also works for annual subscriptions — just change the frequency property.

3. Loan Payoff Countdown

Motivation is everything when paying off debt.

- In your Loan Tracker, set a Target Payoff Date.

- Use a formula to show “Days Remaining” until that date.

- Link it to your payment logs so the countdown adjusts as you make extra payments.

💡 The visual payoff countdown in my template turns debt reduction into a gamified challenge you’ll actually want to win.

4. Automated Monthly Finance Report

At the end of each month, you want to know three things: how much you earned, spent, and saved.

- Use filtered views or roll-ups to total all income and expenses for the month.

- Subtract expenses from income to get cash flow.

- Add a progress bar formula to visualize your savings rate.

💡 In the Ultimate Finance Template, the monthly report updates automatically — so you open your dashboard and instantly see:

- Total Income

- Total Expenses

- Net Savings

- Cash Flow Progress Bar

How to Track Smarter, Not Harder?

Managing your finances in Notion isn’t just about logging numbers — it’s about creating a system that runs smoothly in the background, keeps you informed, and frees up your time for the things that matter. With automation, recurring expenses appear when they should, countdowns keep you ahead of bills and loans, and monthly reports show exactly where your money is going.

You could spend hours building this workflow from scratch… or you could start today with a ready-made system that already does it all.

The Ultimate Finance Template includes every feature from this guide — account balances, budget tracking, spending logs, loan payoff countdowns, subscription reminders, automated monthly reports — all fully linked and ready to use.

Start tracking your finances like a pro — and skip the setup.

👉 Get the Ultimate Finance Template here

Frequently Asked Questions

How to choose the best Notion template for personal finance?

The best Notion template for personal finance is one that combines budget planning, expense tracking, savings goals, and debt repayment in one connected dashboard. Look for templates with automated calculations, linked databases, and visual reports so you can see your cash flow at a glance. For example, the Ultimate Finance Template offers a complete all-in-one setup where income, expenses, loans, and goals are fully integrated for accurate, real-time tracking.

Can I automate personal finance tracking in Notion?

While Notion can’t connect to banks directly, you can automate parts of your workflow. For example, set up recurring expense templates for rent, utilities, or subscriptions, add countdowns for loan payoff dates, and generate monthly reports automatically using linked databases and formulas. Templates like the Ultimate Finance Template include these automations pre-built.

Can I customize a Notion finance template to fit my needs?

Absolutely. Most Notion finance templates are fully customizable — you can add new categories, change currency symbols, adjust colors, or create extra trackers for things like investments, debt snowball plans, or business income.

How do I track multiple accounts in Notion?

A good Notion finance template lets you track multiple accounts — from checking and savings to credit cards and investment portfolios — by using linked databases. You can set a starting balance for each account, log income or expenses, and watch the end balance update automatically. This gives you a clear, real-time view of your total available funds and helps you avoid overdrafts or missed payments.

Can I use a Notion finance template for debt repayment?

Absolutely — a Notion finance template can include a dedicated loan tracker where you log each debt, interest rate, repayment amount, and due date. You can track progress with visual payoff bars, calculate remaining balances automatically, and even set countdowns to your debt-free date. This works for credit cards, student loans, car payments, and mortgages.

Can I track my finances in Notion on my phone?

Yes, the Notion mobile app works seamlessly with finance templates, allowing you to add expenses, update balances, and check your budget from anywhere. This is especially useful for logging purchases on the go so your data stays accurate.

Can a Notion finance template handle multiple currencies?

Yes. In the expense tracker database, you can change the Number property for the Amount field to display your preferred currency. While the Ultimate Finance Template is set up in US dollars by default, you can easily switch it to any currency — whether it’s GBP, EUR, MYR, or others — so your budgeting, expense tracking, and reports all reflect the correct format for your finances.

.png)